Navigating Import Export Certifications for Best Hole Saws in Stainless Steel Markets

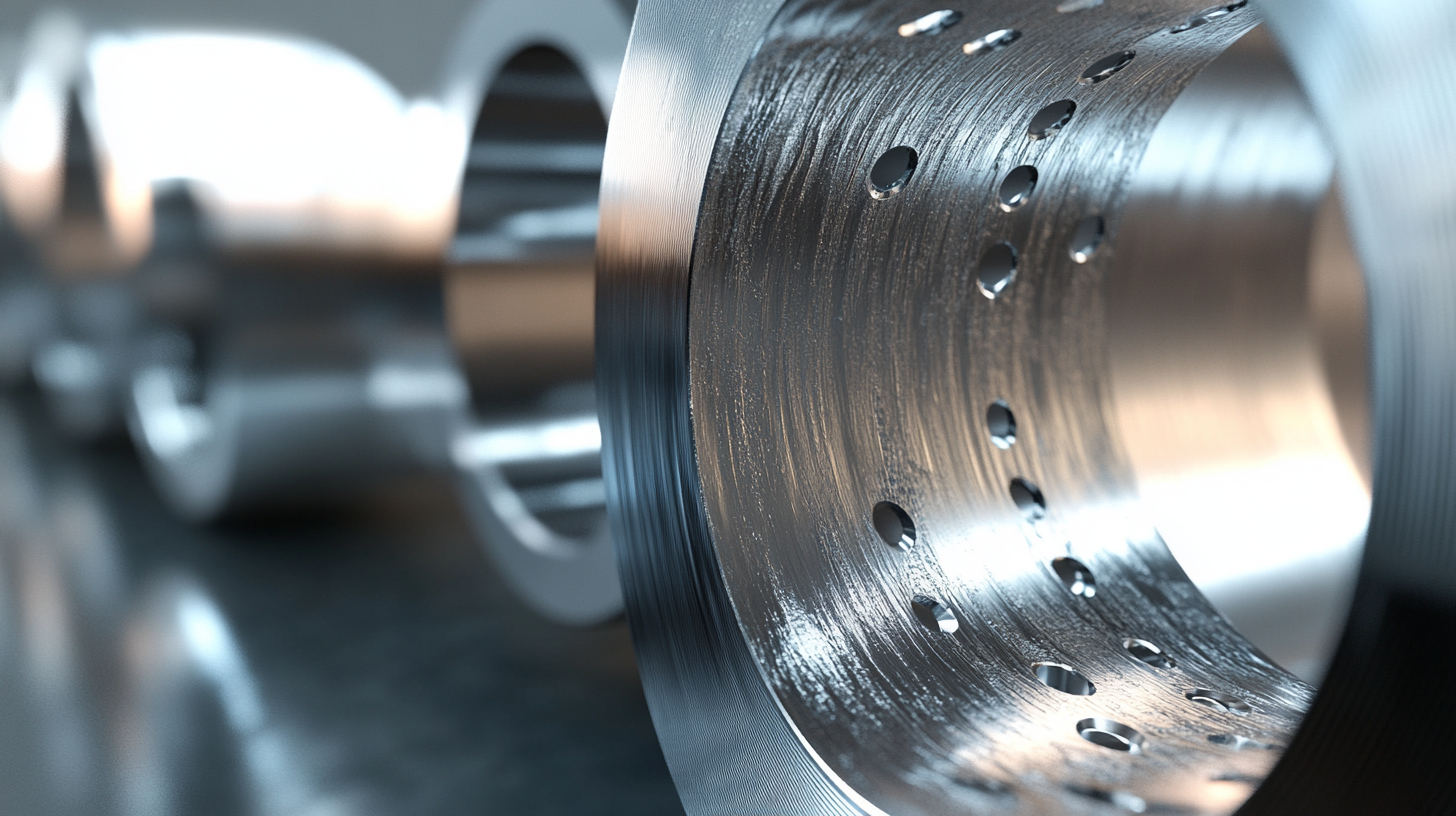

In recent years, the global demand for high-quality hole saws for stainless steel has surged, driven by advancements in manufacturing and construction techniques. According to a recent report by Market Research Future, the stainless steel market is projected to reach USD 137 billion by 2027, with a significant contribution from precision tooling products such as hole saws. As the industry expands, navigating the complexities of import-export certifications becomes increasingly crucial for manufacturers aiming to penetrate international markets. China, recognized as a leading manufacturer, has established a robust export footprint across numerous countries, adapting to various compliance standards. This blog will explore the essential certifications and guidelines needed for successfully exporting hole saws for stainless steel, ensuring that quality and safety are maintained while meeting global market demands.

Navigating the Complex World of Import Export Certifications for Hole Saws

Navigating the complex world of import-export certifications for hole saws requires a keen understanding of various regulations and potential changes in trade policies. Recent discussions among experts surrounding the relaxation of phytosanitary rules in Europe highlight the evolving landscape of import regulations. The new SPS agreement, which proposes the removal of plant health certificates, can significantly impact import-export costs, potentially allowing businesses to save notable amounts per certificate. This shift could streamline the certification process for businesses importing stainless steel hole saws, making it easier for them to navigate regulations while maintaining product quality.

The impact of these regulations is particularly relevant in a global market where competition can come from unexpected sources. For instance, the influx of cheap imports, such as certain products in the tyre industry, illustrates how international trade dynamics can affect local industries. As countries adapt to new import-export policies, manufacturers of stainless steel hole saws must remain vigilant. They need to leverage any potential reductions in certification burdens while ensuring compliance to safeguard their market position. Understanding and adapting to these complexities can provide significant advantages in meeting the growing demands within global steel markets.

Navigating Import Export Certifications for Best Hole Saws in Stainless Steel Markets

This chart illustrates the number of various certifications obtained for hole saws in stainless steel markets. Understanding these certifications can be crucial for navigating import/export processes effectively.

Key Import Export Regulations Impacting Stainless Steel Markets

Navigating the complexities of import and export certifications is crucial for companies engaged in the stainless steel markets, particularly in the seamless pipes segment. According to industry reports, the Stainless Steel Seamless Pipes Market is projected to reach USD 5.15 billion by 2030, highlighting a robust demand driven by sectors such as construction, automotive, and oil and gas. Understanding the key import-export regulations that govern these markets is essential for businesses looking to tap into this growth.

Regulatory compliance plays a significant role in the international trade of stainless steel products. Different countries enforce varying certification requirements, which can affect the cost and efficiency of exports. Companies must stay informed about these regulations, including material certification, quality assurance, and environmental standards, to ensure their products meet the necessary criteria for entry into foreign markets. This diligence not only enhances market access but also builds credibility and trust with overseas partners, further driving business growth in the competitive stainless steel industry.

Emerging Technologies in Hole Saw Design for 2025

As the demand for precision cutting tools continues to rise, the development of hole saws is embracing emerging technologies that promise to revolutionize the market by 2025. Innovations such as advanced materials, laser cutting, and 3D printing are paving the way for stronger, more durable hole saws. These technologies not only enhance performance but also improve production efficiency, reducing costs for manufacturers and consumers alike.

**Tip:** When selecting your hole saws, look for products that incorporate advanced material technology. Tools made with high-speed steel or carbide-tipped designs typically offer longer life and resistance to wear, ensuring optimum performance in demanding stainless steel applications.

Another exciting trend on the horizon is the integration of smart technology into hole saw designs. Features such as sensors that provide real-time performance data will help users monitor wear and tear, enabling proactive maintenance and reducing downtime. This shift towards smarter tools represents a significant leap forward in maximizing productivity in metalworking environments.

**Tip:** Keep an eye on manufacturers that promote smart technology in their hole saws. Investing in these tools can ultimately save you time and money, allowing for more efficient project management and increased overall output.

Sustainable Practices in the Production of Stainless Steel Hole Saws

Sustainable practices in the production of stainless steel hole saws have become increasingly important as the industry looks to minimize its environmental footprint. According to a recent report by the International Stainless Steel Forum, around 60% of stainless steel is now produced using recycled materials, significantly reducing raw material extraction and energy consumption. This shift not only decreases emissions but also promotes a circular economy within the metalworking sector, making the production of high-quality hole saws more eco-friendly.

To ensure sustainable practices, manufacturers are adopting advanced techniques in their production processes. For instance, incorporating energy-efficient machinery and utilizing renewable energy sources can reduce carbon emissions by up to 30%, as noted in a study by the World Steel Association. Furthermore, prioritizing waste reduction through lean manufacturing processes leads to less scrap materials and lower costs.

**Tip: When selecting stainless steel hole saws, look for those produced by companies that emphasize sustainable manufacturing practices.** This not only supports environmentally friendly initiatives but also often results in higher-quality products.

**Tip: Consider the lifecycle of the hole saws you purchase.** Investing in durable and sustainable products may have a higher initial cost but can save money in the long run through reduced replacement frequency and lower environmental impact.

Navigating Import Export Certifications for Best Hole Saws in Stainless Steel Markets - Sustainable Practices in the Production of Stainless Steel Hole Saws

| Certification Type | Description | Country of Origin | Sustainability Practices | Environmental Impact |

|---|---|---|---|---|

| ISO 9001 | Quality Management Systems | Germany | Recycling of scrap metal | Low emissions |

| CE Marking | Conformance to health, safety, and environmental protection standards | France | Use of renewable energy sources | Minimal waste production |

| RoHS Compliance | Restrictions on Hazardous Substances | Italy | Sourcing of eco-friendly materials | Low toxicity |

| FSC Certification | Sustainable Forest Management | Sweden | Sustainable sourcing | Biodiversity preservation |

| Energy Star | Energy efficiency certification | USA | Energy reduction strategies | Lower energy consumption |

Best Strategies for Ensuring Compliance in Global Trade of Hole Saws

In the competitive market for stainless steel hole saws, ensuring compliance with import and export certifications is crucial for businesses looking to thrive in global trade. According to a recent report by Market Research Future, the stainless steel tools market is projected to grow at a CAGR of 5.3% over the next five years. To capitalize on this growth, manufacturers must navigate a complex web of regulations that vary by country, impacting everything from product standards to packaging requirements.

One effective strategy for maintaining compliance is to stay abreast of international standards such as ISO 9001 and ISO 14001. Companies can utilize these frameworks to streamline their certification processes. In addition, leveraging technology like blockchain can enhance traceability and transparency in supply chains, reducing the risk of non-compliance. A report from Deloitte highlights that organizations employing advanced compliance solutions witness a 30% improvement in operational efficiency, which is essential in meeting the demanding requirements of global trade while maintaining competitiveness in the stainless steel sector.